Learn from global and country experience

Start here to learn about how to review and apply guidance from international standard-setting bodies (SSBs) and lessons learned from country experience.

+ 1. How this guide can help

This guide can help you to ensure that your digital financial services (DFS) policies and regulations are informed by guidance from international SSBs and relevant country experience. Each country will need to individually evaluate the applicability of particular guidance and experience to its specific country context.

- Learn more about global SSBs and other international stakeholders that are relevant to DFS policy and regulation;

- Identify relevant standards (principles, policies, and practices) set by internationally recognized SSBs and other relevant international stakeholders;

- Identify relevant country practices; and

- Learn how to ensure that your DFS policies and regulations are informed by relevant standards and country practices while taking into account your national context.

+ 2. Examples of when to use this guide

If you are designing an enabling regulation for DFS, use the tools in this guide to discover relevant existing global standards and country experience that should inform the regulatory design process.

If you are considering a new DFS policy, use the tools in this guide to learn about country experience, existing global standards for DFS policies, and the list of internationally recognized bodies that set these standards.

This guide includes

- Learn about the work of global standard-setting bodies and other relevant international organizations

- Identify relevant standards and guidance from SSBs and other relevant international stakeholders

- Identify relevant country practices

- Consider country context

- Potential next steps

Contact us to learn more.

+ 3. Learn about the work of global standard-setting bodies and other relevant international organizations

CGAP has identified four basic regulatory enablers for inclusive DFS:

- E-money issuance by nonbanks

- Use of agents

- Risk-based customer due diligence

- Consumer protection

Below is a non-exhaustive list of SSBs whose standards are related to the four DFS regulatory enablers.

- Financial Stability Board (FSB): The FSB coordinates the financial policymaking work of national financial authorities, other SSBs, and international financial institutions.

- Basel Committee on Banking Supervision (BCBS): The BCBS is the primary SSB for prudential regulation of banks worldwide.

- Committee on Payments and Market Infrastructures (CPMI): The CPMI is the primary SSB promoting safe and efficient payment systems.

Financial Action Task Force (FATF): The FATF is the primary SSB aiming to combat money laundering and terrorist financing.

International Association of Deposit Insurers (IADI): The IADI is the primary SSB promoting effective deposit insurance systems.

- International Association of Insurance Supervisors (IAIS): The IAIS is the primary SSB promoting effective regulation and supervision of the insurance industry.

- International Organization of Securities Commissions (IOSCO): The IOSCO is the primary SSB for the securities sector.

In addition to SSBs, many international organizations have published guidance relevant to the four DFS regulatory enablers. Some examples include:

- Alliance for Financial Inclusion (AFI): The AFI is an alliance of central banks and other financial authorities that aims to promote financial inclusion in member countries.

- Bill & Melinda Gates Foundation: The Gates Foundation is a private foundation aiming to create a world where every person can live a healthy and productive life.

- Consultative Group to Assist the Poor (CGAP): The CGAP is a global partnership of development organizations seeking to improve the lives of poor people through financial inclusion.

- G20 Global Partnership for Financial Inclusion (GPFI): The GPFI is a platform for G20 countries and other stakeholders to promote financial inclusion efforts.

- GSMA: The GSMA represents the interests of the mobile communications industry.

- OECD: The OECD is an international organization that establishes standards aimed at addressing social, economic, and environmental challenges.

- World Bank: The World Bank works to reduce poverty and promote economic development in developing countries.

+ 4. Identify relevant global DFS standards and guidance from SSBs and other relevant international stakeholders

Now that you’ve familiarized yourself with the work of global standard-setting bodies and other relevant international stakeholders, you can identify global DFS standards and good practices that are relevant to your country. This spreadsheet includes some examples as of June 2022. Additional examples can be found on the websites listed above.

+ 5. Identify relevant country practices

Once you have a strong understanding of DFS standards, you can look for examples of how specific countries have implemented these standards in practice. The following tools can help you to identify relevant country examples:

UNCDF’s benchmarking database is a catalogue of regulatory provisions included in the DFS regulatory frameworks of more than 50 African countries. In addition to summaries of relevant provisions, the database provides links to directly download the regulations of interest for further information.

The database addresses all four of the basic DFS regulatory enablers. Regulatory provisions for each DFS regulatory enabler include the following:

E-money licensing

- Definition of e-money

- Nonbanks allowed to issue e-money

- List of actors allowed to issue and commercialize e-money

- Permitted activities for e-money issuers

- Minimum capital requirements for e-money issuers

- Float retention and investment requirements

- Recordkeeping requirements

Use of agents

- Use of agents allowed

- Categories of financial service provider (FSP) allowed to use agents

- Agent regulation by category of FSP

- FSP liability for agents’ actions

- Consumer protection mechanisms for use for agents

- Agent eligibility rules

- Permitted activities for bank vs. nonbank agents

- Rules governing exclusivity

- Different agent models

Customer due diligence

- Official ID required to open a bank account

- Existence of tiered KYC

- Number of tiers / account levels

- Thresholds (transaction and balance limits)

- ID requirements

- Share of population without a national ID

- Share of women without a national ID

Consumer protection

- Governance

- Security

- Data protection and privacy

- Fair treatment

- Complaints handling mechanisms

- Disclosure and transparency

Contact us to access the database.

The GSMA’s Mobile Money Regulatory Index (MMRI) assesses mobile money regulatory frameworks across 90 countries worldwide. Scores range from 0-100, with higher scores associated with more enabling regulation.

Regulatory topics included in the index include:

Authorization

- Eligibility

- Authorization instruments

- Capital requirements

- International remittances

Consumer protection

- Safeguarding of funds

- Consumer protection roles

- Deposit insurance

Transaction limits

- Entry-level transaction limits

- Entry-level monthly limits

- Entry-level balance limits

- Maximum transaction limits

- Maximum monthly limits

- Maximum balance limits

Know-Your-Customer (KYC)

- Permitted identifications

- KYC requirements

- KYC proportionality

Agent networks

- Agent eligibility

- Agent authorization

- Agent activities

- Agent liability

Investment and infrastructure environment

- Financial inclusion strategy

- Affordability

- ID verification infrastructure

- Interoperability

- Settlement access

- Interest payments

Go to the GSMA Mobile Money Regulatory Index (Excel) here.

The Bill & Melinda Gates Foundation’s Financial Services for the Poor (FSP) program developed “Inclusive Digital Financial Services: A Reference Guide for Regulators (PDF)” to assist regulators who are exploring policy options for enabling the development of inclusive digital financial services.

The guide summarizes key regulations from around the world related to topics such as:

- Licensing

- Prudential regulation and supervision

- Competition issues

- Integrity and security

- Agent regulation and supervision

- Consumer protection

The guide reflects the contributions of:

- The Alliance for Financial Inclusion (AFI)

- The Consultative Group to Assist the Poor (CGAP)

- The United Nations Capital Development Fund (UNCDF)

- The Office of the United Nations Secretary General’s Special Advocate for Inclusive Finance for Development (UNSGSA)

- The World Bank

Go to Inclusive Digital Financial Services: A Reference Guide for Regulators (PDF) (Only available in English)

Index of Inclusive Digital Financial Services: A Reference Guide for Regulators (Airtable)

Our tool built on the “Inclusive Digital Financial Services: A Reference Guide for Regulators” is an interactive index for the guide.

You can sort, group, and filter the tool by DFS regulatory enablers, sub-themes, and country examples. The tool also includes the relevant slides from the guide in each section.

- Open the Airtable in a new tab to explore the index.

- Explore our pre-made views or sort, group, and filter the tool.

Click “View larger version” in the bottom righthand corner to open it in a new tab. The view below is an example of a “gallery view.” Click “View larger version” in the bottom righthand corner to open it in a new tab.

+ 6. Consider country context

Before applying insights gathered from international and domestic experience, you will need to assess whether the proposed regulatory approaches will work in your country context. For example, some approaches to safeguarding customer funds in countries with a common-law legal tradition may not work in countries with a civil-law legal tradition. Similarly, approaches to customer onboarding that have succeeded in countries with ubiquitous digital ID uptake might not work in countries without universal ID access.

While it is important to ensure that proposed regulatory approaches will be feasible in your country context, it is equally important to not focus exclusively on solutions from countries that are similar with respect to size, location, level of development, demographics, legal system, or other characteristics commonly used to define “peer” markets. Overemphasizing the importance of country similarity could lead to the adoption of less technically sound solutions and to overlooking more appropriate regulatory solutions because they come from countries that are “too different.” Examples of country DFS regulatory approaches that have influenced “dissimilar” countries include:

- E-money regulation: Elements of the EU’s E-Money Directive informed the development of similar regulations in various low- and middle-income countries (LMICs), despite the obvious economic and demographic differences.

- Use of agents: Brazil’s approach to the use of agents informed agent regulations in Kenya, Pakistan, and other countries that might not be obvious peer country candidates.

- Deposit insurance: The USA’s approach to pass-through deposit insurance informed the inclusion of similar provisions in other e-money regulations.

This is not intended to dismiss the importance of ensuring that key stakeholders – especially public-sector decisionmakers – consider regulatory approaches from other markets to be relevant to their country context. For example, policymakers in some countries are not interested in following Kenya’s approach to e-money regulation because they feel that Kenya is too different. Whenever possible, it is helpful to cite examples from countries that match policymakers’ preferences – which depending upon the country could be peers and/or non-peer countries with more developed DFS ecosystems. Where such examples are lacking or do not reflect good practice, however, it is important to make a case for learning from markets that may be dissimilar in certain respects.

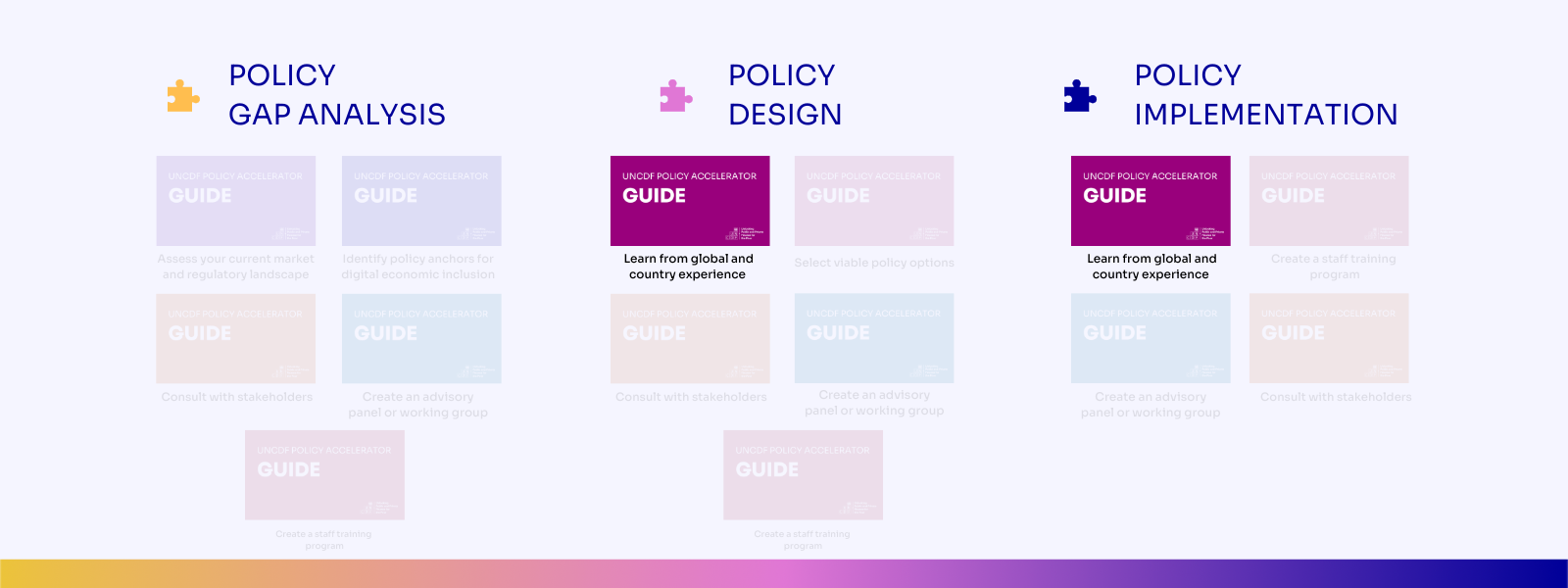

UNCDF Policy Accelerator Toolkit

This guide is part of the UNCDF Policy Accelerator Toolkit. Watch a video overview in English or French to learn more.

Watch the overview in English.

Watch the overview in French.